Key takeaways

If you’re 70 ½ or older, a qualified charitable distribution (QCD) from your IRA directly to one or more qualified charitable organizations allows you to avoid claiming income from an IRA distribution.

Directly contributing a QCD to a charitable organization helps you avoid a direct tax hit, can satisfy all or part of your RMD if you’re 73 and older, and can help reduce the size of your estate.

Your tax and financial professionals can help you determine whether a QCD is an appropriate charitable giving option for your overall wealth plan.

Just as with other aspects of your financial life, your charitable giving should be built around a strategy. Your primary desire may be to support your favorite charitable organizations, but you also want to be sure you fully capitalize on the tax benefits available to you.

The best gifting approach is to put thought into your charitable giving strategy, rather than making donations on a whim. For example, cash gifts tend to be the default option for many, but that may not be the most tax-efficient way to give.

If you have built significant sums in a traditional IRA and are at least age 70 1/2, there may be more tax-efficient gifting strategy available to you in the form of a qualified charitable distribution, or QCD.

Qualified charitable distributions offer a prime opportunity to enhance your charitable giving and maximize your tax savings.

What is a qualified charitable distribution?

A QCD allows you to contribute a certain amount directly from your IRA to one or more qualified charitable organizations in a tax-efficient way. If you’re subject to required minimum distribution (RMD) rules, which apply after you reach age 73, a direct transfer from your IRA to qualified charities allows you to avoid claiming income from an IRA distribution when you make your charitable donation.

A qualified charitable distribution from a traditional IRA has distinct advantages over making a direct cash donation to a charity. With a QCD, you do not claim any income from the distribution. Instead, the full amount of your donation (up to $108,000 in 2025, indexed annually for inflation) goes to the directed charities, so you avoid a significant taxable increase to your income.

This may allow you to remain in a lower tax bracket and potentially avoid the 3.8% net investment income tax (NIIT). It also allows you to maintain a lower level of income to minimize your tax liability on Social Security benefits or keep your income below thresholds that would add expense to Medicare Part B premiums.

Benefits of a QCD

There are three major benefits of a QCD for donors:

- A QCD limits the immediate tax hit. For example, if you took a distribution of $108,000 from your traditional IRA, most or all the distribution would be taxable at ordinary federal income tax rates (up to a top rate of 37%). Not counting state and other taxes, this would result in a net distribution of just $68,040 if you’re in the highest tax bracket.

- A QCD can satisfy all or part of your RMD at age 73. If you don’t need to receive a distribution from your traditional IRA at age 73, a QCD becomes a more efficient way to make a charitable donation, which can qualify as all or part of your RMD.

- A QCD can help reduce the size of your estate. For example, if you and your spouse have large IRAs, your estate can be reduced by up to $216,000 without any tax considerations, while still benefiting charitable organizations.

How to set up a QCD

To set up a QCD, you submit a distribution form to your IRA custodian and request that a check be made payable and sent directly to the charitable organization or organizations you designate. You will then report the QCD on IRS Form 1040 when filing your federal income tax return, entering $0 as the taxable amount of the distribution.

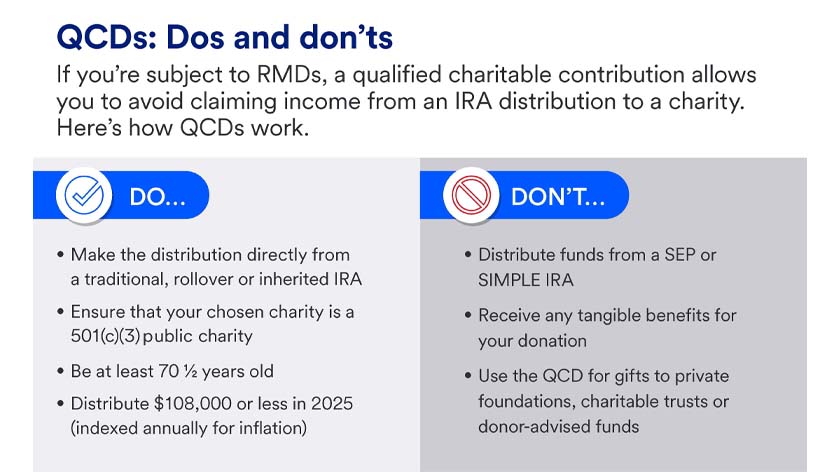

Here are four important things to note before you set up a qualified charitable distribution:

- The distribution must be made directly from a traditional, rollover or inherited IRA to the charitable organization. If the contribution is made by check, the check should be made out to the charity and sent directly to it. If the check is made out to you, and you deposit it and then write a check payable to the charity, the distribution will not be considered a QCD and you’ll lose any tax benefits.

- You must be at least 70 ½ years of age in 2025 to make a qualified charitable distribution.

- The QCD limit in 2025 is $108,000. This amount will be indexed annually for inflation.

- The charity or charities you donate to must meet the IRS definition of a qualified charitable organization, which is also sometimes referred to as a 501(c)(3) organization. Most educational, scientific, faith-based and literary organizations qualify as 501(c)(3) public charities, as do well-known charities like United Way, Habitat for Humanity and Feeding America.

Other qualified charitable distribution rules

- If you’re married with separate qualifying IRAs, you and your spouse can each donate up to $108,000 in 2025 from your respective IRAs using QCDs.

- QCDs are an option for those who own traditional, rollover or inherited IRAs. SEPs and SIMPLE IRAs cannot be used as vehicles to execute a QCD.

- If you have an inherited IRA, the RMD rules do not apply; however, you have only 10 years to fully liquidate the IRA.

- If you receive any tangible benefits in return for your charitable donation, whether it’s a tote bag or your name on a building, the IRS will disallow the QCD and you’ll forfeit any tax benefits. In this case, you can still deduct the cash value of the gift if you itemize deductions on your income tax return.

- QCDs cannot be used for gifts to private foundations, charitable trusts or donor-advised funds.

- A provision in the Secure 2.0 Act provides a one-in-a-lifetime opportunity to use a QCD to fund a charitable remainder unitrust (CRUT), charitable remainder annuity trust (CRAT) or charitable gift annuity (CGA). You can direct up to $54,000 (indexed annually for inflation) using this one-time distribution option. If you direct a distribution to a CRUT or CRAT, it must be the only form of funding for that trust.

Consider how a qualified charitable distribution works within your wealth plan

Qualified charitable distributions offer a prime opportunity to enhance your charitable giving and maximize your tax savings. QCDs should be considered as part of a broader gifting strategy.

It may help to talk to your financial professional about how best to incorporate your giving goals into your larger wealth plan. And be sure to consult with your tax advisor to fully understand the rules and tax ramifications of your charitable giving options.

Learn how Philanthropic Services from U.S. Bank can help you craft your philanthropic vision.

Explore more

Your charity donation tax deduction guide

Charitable donations can help your wealth make a greater impact – and by maximizing tax deductions for donations, you can help your money go even further.

Bring your charitable giving vision to life.

Philanthropic Services from U.S. Bank serves individuals, families and family foundations, as well as public charities and nonprofit organizations.