Capitalize on today’s evolving market dynamics.

With markets in flux, now is a good time to refocus your investment strategy.

Key takeaways

As one of the top five industries represented in the S&P 500 Index, healthcare stocks play an important role today in many investors’ portfolios.

Following mediocre 2024 performance, health care stocks are off to a solid start this year.

There’s a significant disparity between “winners” and “losers” among healthcare stocks, which creates opportunities and risks investors should consider.

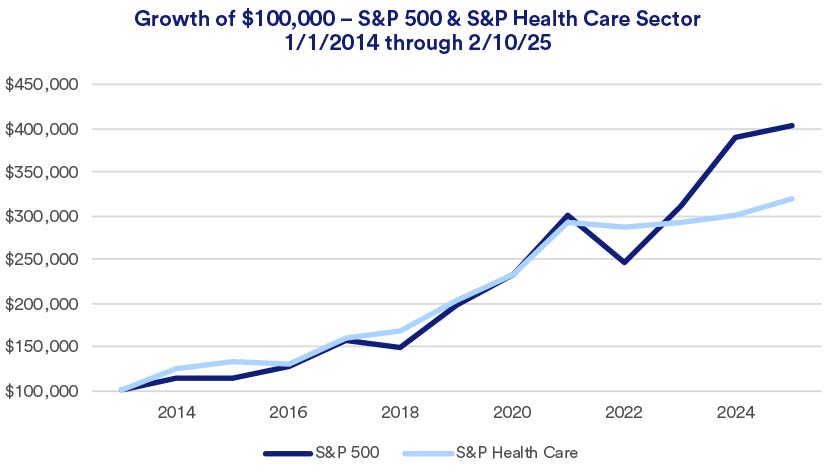

So far in 2025, healthcare stocks represent one of the best performing S&P 500 sectors, outpacing the broader S&P 500 index. This was in sharp contrast to recent underperformance. In 2024, the S&P 500 healthcare sector gained just 2.06%, significantly lagging the S&P 500’s 25.02% total return. Results in 2023 were similar, with the S&P 500 up 26% compared to gains of 2.0% for healthcare.

Recent performance shortfalls don’t reflect the healthcare industry’s important economic role. An aging population results in growing demand for medical-related products and services, so healthcare remains an integral part of the world’s economic picture.

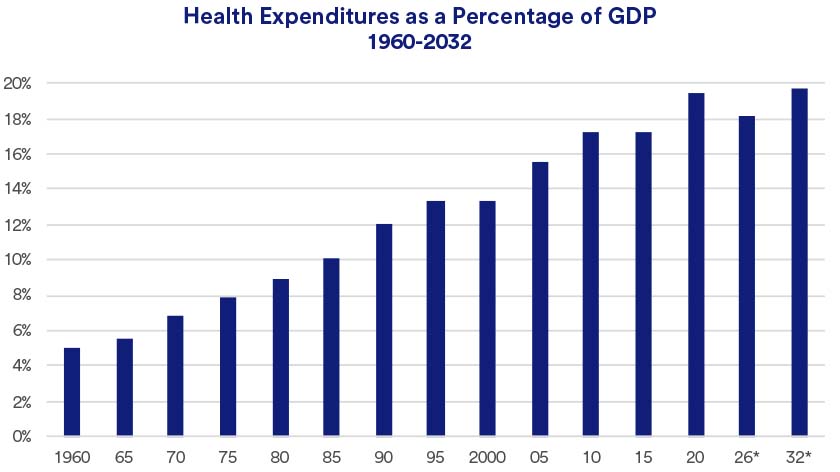

Healthcare spending currently represents more than 17.5% of the nation's economy, as measured by Gross Domestic Product (GDP). That’s down from a peak near 20% of GDP in 2020, the initial year of the COVID-19 crisis. However, spending is projected to continue rising at a level that modestly outpaces GDP, growing to nearly one-fifth of the nation’s economy by 2032.

“The sector should be positioned to benefit in the long run from an aging population, which requires more healthcare spending,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. “However, at least in the short term, that hasn’t been working.”

Nevertheless, Haworth notes that healthcare corporations reported favorable 2024 earnings, estimated to grow at more than 5% for the year, and more than 11% year-over-year in 2024’s fourth quarter.1

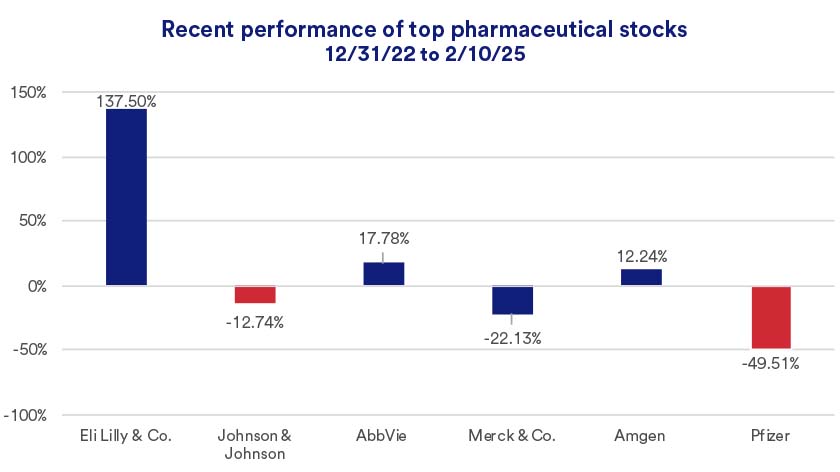

“If you look closer, there’s a significant differentiation of performance between the industry’s winners and losers,” says Haworth. For example, Eli Lilly & Co. stock enjoyed dominating performance dating back to 2022, as the popularity of its drugs aimed at treating diabetes and obesity proved extremely profitable. By contrast, Pfizer’s stock soared beginning in late 2020 and through 2021 on the strength of its leadership role in delivering COVID-19 vaccines. However, the company’s stock has struggled more recently as it awaits its next big breakthrough. “When you think of the time it takes for drug discoveries along with the patent process, you can understand why performance can vary between stocks and across different time horizons,” says Haworth. “It creates a rotational cycle of winners and losers.”

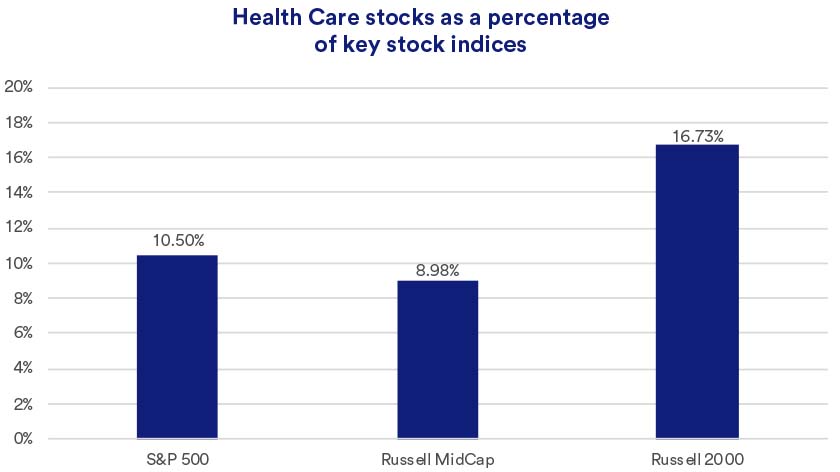

Healthcare represents the fourth largest sector in the large-cap S&P 500 Index, behind the information technology, financials and consumer discretionary sectors.1 It is the fifth-largest sector in the Russell MidCap Index (an index of about 800 stocks). Within the small-cap Russell 2000 Index, healthcare is the third largest sector, trailing only industrials and financials.3

“If you look closer, there’s a significant differentiation of performance between the industry’s winners and losers."

Rob Haworth, senior investment strategy director, U.S. Bank Asset Management

From 2014 to 2022, the healthcare sector tracked closely with the broader market. Since that time, as technology stocks soared, healthcare stocks lagged. In the past 2+ years, healthcare stocks gave up significant ground to the broader index.

“Investors can gain exposure to the healthcare sector by owning the S&P 500 through a passively managed index fund or ETF,” says Haworth. “Investors may also want to take a more selective approach, as the record demonstrates there can be varied performance within the healthcare sector.”

In early 2025, investors are taking a wait-and-see approach regarding potential new Trump administration policies. Under nominated Health and Human Services Secretary Robert F. Kennedy, Jr., major companies in the industry could face greater scrutiny and need to adapt to different policy approaches than was the case previously. “The concerns surrounding Kennedy’s nomination seemed to play out more as 2024 wound down,” says Haworth, “but no specific policy changes are yet on the table that may impact larger healthcare companies.”

Additionally, the disparate fortunes of healthcare sector participants, which can change significantly over time, create some challenges for investors. “There are clear opportunities in more active management of healthcare investments given the push-pull dynamic of demand relative to the winners-and-losers system in the pharmaceuticals field,” says Haworth. “For others, relying on a passive management approach, an S&P 500 Index fund or ETF, may be the best way to access the investment potential of the healthcare sector.”

As you explore such investment opportunities, be sure to discuss it with your financial professional. You’ll want to consider how healthcare investments can work within the context of your overall financial plan and investment strategy.

Healthcare represents one of the largest sectors of the major market indices. As of February 10, 2025, it was the fourth-largest sector in the large-cap S&P 500,1 and the second-largest industry sector in the small-cap Russell 2000 Index.3 With healthcare services representing more than 17% of the economy,1 healthcare plays an important role in the portfolios of many investors.

According to S&P Dow Jones Indices, the healthcare sector was expected to contribute approximately 12.6% of estimated corporate earnings generated by S&P 500 companies in 2024’s fourth quarter. Healthcare ranked behind only the financials and information technology sectors in terms of contributions to the S&P 500’s earnings. S&P’s estimates project healthcare stocks will generate earnings growth of 10.2% in 2024, outpacing earnings growth expectations for the broader S&P 500.2

Over the past 50 years, healthcare has become an increasingly visible component of the U.S. economy. Significant expenditure growth occurred between 1960 and 2005, growing from 5% in 1960 to 15% of the economy in 2005. Expenditure growth as a percent of the nation’s economy (using Gross Domestic Product or GDP) has moderated since, except for a spike in costs in 2020, the year that COVID-19 emerged. In 2024, healthcare spending is projected to represent 17.7% of the economy, and grow to close to one-fifth of GDP by 2032.2 The rise in healthcare spending is related in part to the aging of America’s population, as older Americans represent the largest users of healthcare services.

With the market and economy in flux, how should investors position their portfolios to capitalize on potential opportunities, while guarding against risks?

We can partner with you to design an investment strategy that aligns with your goals and is able to weather all types of market cycles.