Capitalize on today’s evolving market dynamics.

With markets in flux, now is a good time to refocus your investment strategy.

Key takeaways

Cash and cash equivalents can provide liquidity, portfolio stability and emergency funds.

Cash equivalent securities include savings, checking and money market accounts, and short-term investments.

A general rule of thumb is that cash and cash equivalents should comprise between 2% and 10% of your portfolio.

In an era of higher interest rates, investors may naturally wonder if it’s appropriate to increase cash positions in their portfolios. Short-term cash opportunities appear attractive, but those seeking to achieve long-term goals need to position assets with their goals and time horizon in mind.

There’s a proper role for cash in any asset mix. It is always important to have cash on hand to meet emergency needs or to fund short-term opportunities. Cash can also play an important role in long-term financial planning. Yet investors always want to be cautious about holding too much cash. This is particularly true at a time when higher yields are available on cash-equivalent vehicles.

What are cash equivalent vehicles? They’re typically defined as accounts like savings, checking and money market accounts, as well as short-term investments with maturities less than 90 days, such as CDs, bonds and Treasuries.

“From an investor’s perspective, cash serves different purposes depending on the objective,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. “Everybody has a need to maintain at least 3-6 months of income in cash to meet emergency needs or to cover near-term spending plans.”

Within a long-term investment portfolio, Haworth says investors must maintain a different perspective. For example, cash provides retirees with peace of mind that they have sufficient liquid reserves to weather periods of uncertainty or an economic downturn. A portion of a retirement portfolio can be directed to cash equivalents to help meet income needs over a 2- or 3-year period. Those funds won’t be subject to equity or bond market fluctuation.

Investors with years to go before retirement and primarily focused on wealth accumulation have the flexibility to seek higher returns that come with an associated risk. Holding a modest percentage of your portfolio in cash and cash equivalents allows you to quickly take advantage of investment opportunities, particularly at times of market disruptions or fluctuation. “In this case, cash is more part of a transactional process,” says Haworth. “Cash may be held as a result of liquidating one security, but it should be put to work relatively quickly in another investment consistent with your risk tolerance level and long-term goals.”

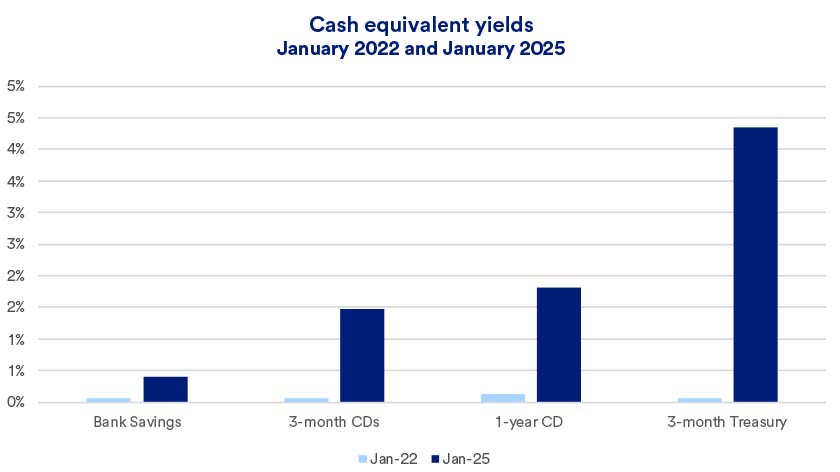

Today’s interest rate environment has dramatically changed compared to even a few years ago. This creates an opportunity to enhance your overall portfolio results. If you have cash "on the sidelines" earning very little return, consider more appropriate options.

“A first step is to move cash into short-term instruments that pay more attractive yields given today’s interest rates,” says Haworth.

Determining the right cash level for your portfolio is a common question, and the answer varies depending on your unique circumstances and current market conditions.

Some factors that help to determine how much to hold in cash and cash equivalents include:

A general rule of thumb is that cash or cash equivalents should range from 2% to 10% of your portfolio. The appropriate amount varies depending on individual circumstances.

One situation where extra cash may make more sense is if you’re planning on a big purchase or expense within the next few years. If you are buying a home, paying for college tuition or undergoing a major home renovation, it makes sense to direct assets to cash vehicles a year or two in advance.

On the other hand, some people might maintain a lower cash position based on their ability to meet short-term cash needs through borrowing. For example, you might be able to tap into a home equity loan or line of credit. It avoids the need to set aside extra cash. A borrowing strategy is most effective when interest rates are low. The current environment’s higher interest rates have made this option less beneficial.

Income and net worth are two additional considerations. For example, if you have a steady income and can count on liquidity from a paycheck or annual bonus, a smaller cash position may be appropriate.

If you work as an independent contractor or have a job where your income stream varies, it may be prudent to keep more in cash reserves. This can help protect against an unexpected income shortfall or unanticipated expense.

For long-term investors, it’s often challenging to find the right balance of cash and cash equivalent holdings relative to other portfolio components. Investors sometimes mistakenly carry too much or too little cash for their situation or they fail to invest cash in a way that earns a competitive yield.

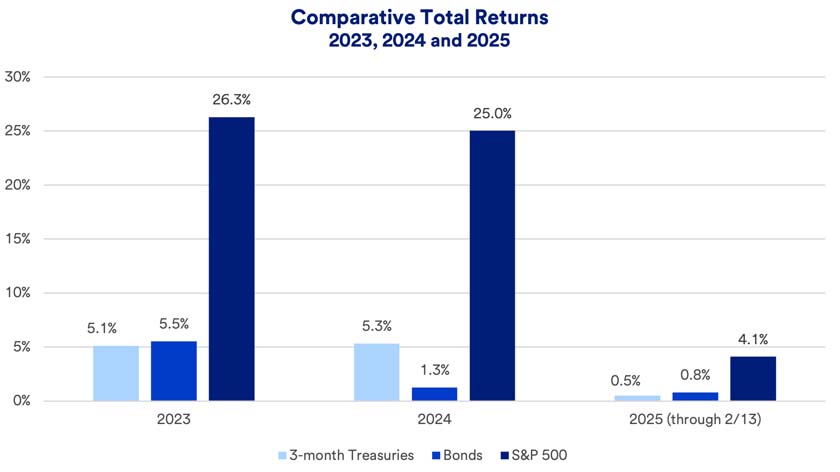

For example, in 2022, both stocks and bonds suffered significant declines. During this time, interest rates rose significantly, and some investors shifted money out of stocks and bonds into cash. While beneficial in the short-term, this strategy might have had negative long-term portfolio consequences.

“Despite the elevated yields for cash vehicles, a diversified portfolio of stocks and bonds likely generated superior performance in 2023, and continues to do so in 2024,” says Haworth. “Historically speaking, a diversified portfolio emphasizing stocks and bonds will outperform cash.”

There are pluses and minuses to being overweight or underweight in cash and cash equivalents, depending on your circumstances and goals.

As always, your cash position should be informed by your financial goals, risk tolerance and time horizon.

As you discuss your plan with your financial professional, the discussion should include the most effective ways to manage cash.

A widely accepted approach is to maintain a cash reserve that’s at least the equivalent of six months of income. A financial professional can offer guidance on any additional cash a client may need to hold based on financial circumstances, as well as how to ladder it into different types of cash equivalents depending on one’s time horizon and unique goals.

Laddering cash into short-, mid- and longer-term investment vehicles can be important because it provides liquidity and backup and is a good way to diversify your fixed-income portfolio.

Laddering cash equivalents into short-, mid- and longer-term investment vehicles can be important because it provides liquidity and backup and is a good way to diversify your fixed-income portfolio.

For example, if your child is going to college, you might decide to set aside cash in a checking or money market account to cover the first semester’s tuition, put the second semester’s tuition in a six-month CD, the following year’s tuition savings in a 12-month CD and so on.

You may also wish to consider laddering cash equivalents in fixed-income assets with maturities on a regular basis, allowing them to reinvest and capture yield as rates go up.

You should assess the percentage of cash and cash equivalents in your investment portfolio at least annually, tied to your regular financial plan review. It’s the most effective way to assure that your portfolio is positioned in a way that will help you achieve your financial goals.

Just as your life evolves, so should your financial plan. Learn how we can help you design a plan that fits your life.

A fresh look at managing your cash and investments in today’s changing interest rate environment can help support your pursuit of the goals that matter most to you.

Let us help you craft a portfolio that reflects your goals, time-horizon and values.