Key takeaways

Buy-and-hold is a passive, long-term investment strategy that creates a stable portfolio over a long period of time to generate higher returns. Instead of trading shares based on stock market timing, investors buy stocks and hold onto them despite any market fluctuation.

Active investing relies on real-time market pricing; investors sell their shares when stock prices are high and buy new shares when prices are low.

A passive investing strategy requires patience and selectivity and can outperform active investing over time.

As long as markets have existed, investors have tried to maximize gains and minimize losses by timing the market.

Timing the market involves attempting to buy when prices are low but rising and sell when prices are high but falling. However, when it comes to stock market timing, you must be successful twice: Once when you buy and then again when you sell.

It’s hard enough to time things correctly on one end, let alone getting the timing right on both ends. Another consideration is that every time you trade, you likely incur brokerage fees and taxes, which quickly reduce your net returns on both the purchase and the sale.

Most investors should consider two important steps – a buy-and-hold approach and building a diversified portfolio that reflects their own investment risk tolerance and investment time horizon.

“Buying and holding equities in the long run has helped investors historically,” says Rob Haworth, senior investment strategy director for U.S. Bank Asset Management. “Investors also need to look at other factors, like how much short-term volatility in stock prices they’re willing to tolerate.”

Instead of timing the market, consider spending time in the market. You may find that a passive investment strategy, such as buying and holding stocks for a long time, can help you accumulate wealth.

“A broadly diversified market portfolio is an important approach to help you manage risk,” Haworth adds.

What is passive investing?

Passive investing, another term for buy-and-hold, means you invest in stocks and other securities with the intention of holding onto them for an extended period regardless of changes in the stock market. You keep your portfolio intact even through short-term, significant market movements and allow the investment to grow over time.

Historically, a large share of the stock market’s gains and losses occur in just a few days of any given year. Since the pattern of returns isn’t predictable from month to month, a consistent investment can add to your bottom line.

A key to passive investing is a willingness to build wealth gradually. Passive investors don’t profit from market timing or short-term market fluctuations. The most popular form of passive investing is to own funds that seek to replicate market indices, such as the S&P 500.

What is active investing?

Active investing involves real-time buying and selling and is intended to seek to regularly generate short-term gains through profitable trading. An active investor, or portfolio manager, constantly monitors the stock market and trades shares when the opportunity arises. However, this does incorporate a variable of timing, and investors take risks of being in and out of investments at the wrong time.

Why you should consider passive investing

There are a few reasons to explore a buy-and-hold investing strategy, all of which are rooted in how stock markets work.

1. Investments can grow despite market fluctuations.

U.S. stock market volatility periodically causes even stalwart buy-and-hold investors to second guess their strategy. However, while past performance is not a guarantee of future returns, history shows that the market has always recovered from declines and provided patient investors with positive returns over time. In fact, over the past 35 years, the market has posted a positive annual return in nearly eight out of every 10 years.1

2. Buy-and-hold keeps you in the game.

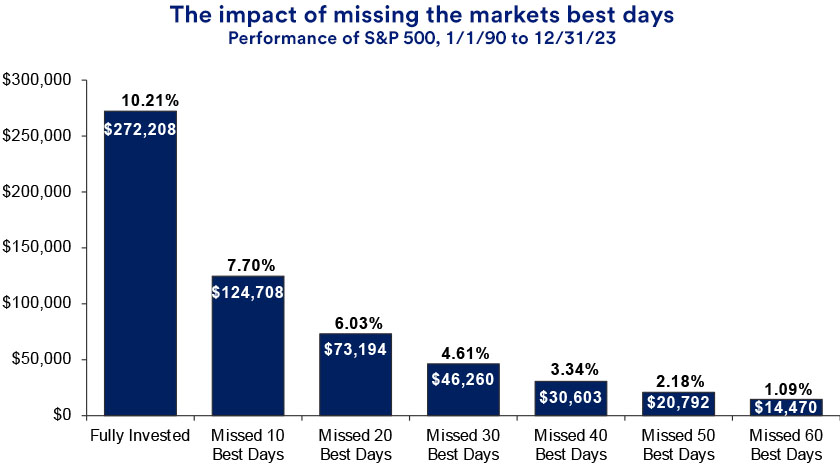

The market’s unpredictable nature makes it difficult to know in advance when the best performance days will occur. As a result, investors reliant on timing the market often miss out on upside potential.

The hardest part about choosing when to be in or out of the market is that missing a few key days or weeks of a five- or 10-year cycle can have a significant influence on your returns. Historically, a large share of the stock market’s gains and losses occur in just a few days of any given year. Since the pattern of returns isn’t predictable from month to month. As shown in this chart, even missing a handful of the best performance days over time can be costly. Instead, consistent, buy-and-hold approach can add to your bottom line.

3. Potential to recoup losses faster.

For most investors, a buy-and-hold strategy can result in quicker loss recovery, even after a bear market, when a major index like the S&P 500 falls by more than 20% from its recent high.

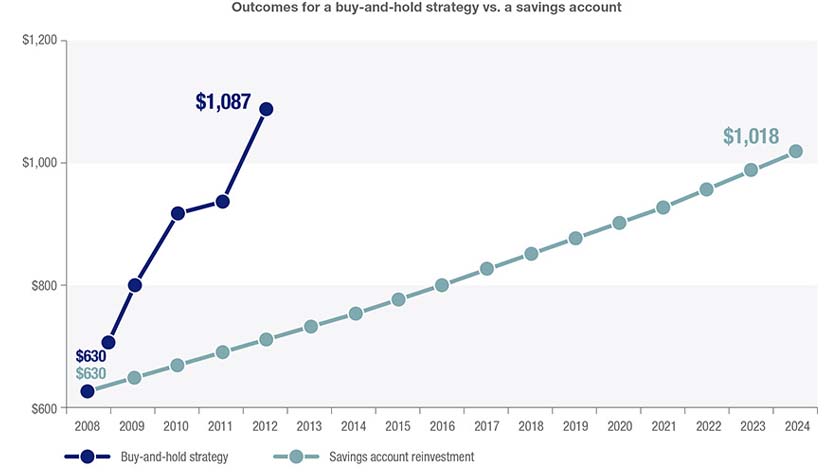

As an example, let’s say you invested $1,000 in the S&P 500 on January 1, 2008. That year, the S&P 500 lost 37% of its value.2 At the end of 2008, your investment was worth $630. Consider the differing outcomes depending on whether you used a buy-and-hold strategy or chose to reinvest $630 into a savings account with a 3% interest rate, compounded monthly.

Using a buy-and-hold strategy, you would have recouped your losses by 2012, even without making additions to your original stock market investment. With your funds in the savings account, in this example, it took 16 years to recoup your losses and cross the $1,000 threshold.

4. Your investment will grow with compound interest.

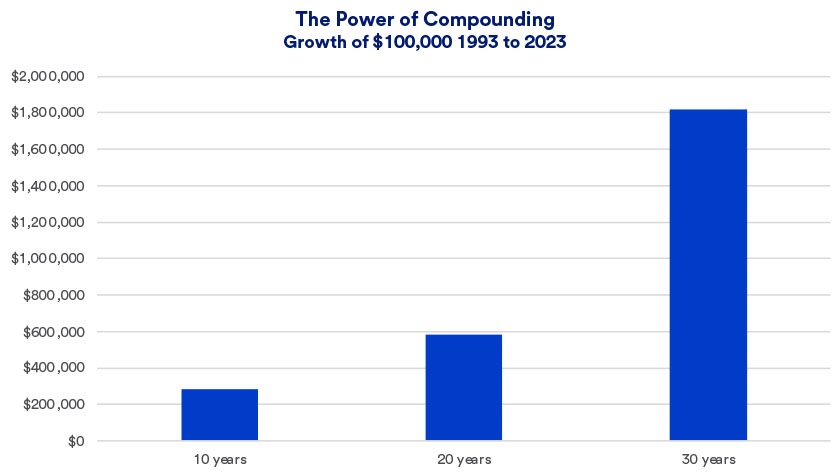

A buy-and-hold strategy can also help you take advantage of compound interest. This is one of the most powerful investment tools for individuals who have time to let their money continue growing. Gains accumulate over time and can provide an advantage to those who invest early and let their money continue to accumulate. For example, $100,000 invested in the S&P 500 more than doubled to $286,000 in ten years, and after 30 years (ending in December 2023), grew to more than $1,800,000.3 While past performance is not a guarantee of future returns, the S&P 500’s inflation-adjusted annual average return on investment is about 7%.3 This means, on average, the index’s value is 7% higher at the end of the year than it was at the beginning. These gains accumulate over time and can provide an advantage to those who invest early and let their money continue to accumulate.

5. You won’t miss out on dividends.

Investors often try to wait for the “right” time to start putting money into the stock market. But in doing so, they sacrifice an important opportunity: collecting dividends.

Don’t underestimate dividends. Even if stock dividend yields seem modest, they add up over time. “If we look over multiple business cycles, dividend reinvestment often represents one-third to 40% of an equity investment’s total return,” says Haworth.2

Many investors choose to automatically reinvest dividends, purchasing additional shares that earn additional dividends. In this way, dividend reinvestment helps you leverage the magic of compound returns.

There are potential downsides to this approach. Automatically reinvesting dividends takes away the opportunity to put that money to work in other investments that might prove more productive. Also, for investments held in a taxable account, even if dividends are reinvested, they are subject to current taxation. Be sure to check with your tax advisor.

If saving for retirement is your primary investment objective, you might want to turn off dividend reinvestment once you’ve stopped working. Instead, you can collect the dividends paid as cash distributions that you can put toward living expenses. Before retirement, however, reinvesting dividends can help maximize your gains and set you up for the potential to receive higher payouts in the future.

Passive investing: Strategies for buy-and-hold investors

The two primary buy-and-hold investing options are:

- Lump sum investing. You invest a large chunk of money all at once. You might have a lump sum of cash from the sale of a family business, the sale of company stock, an inheritance or proceeds from an insurance policy claim, for example. The sooner you invest, the sooner you begin earning returns and start the process of accumulating compound returns.

- Dollar cost averaging. With dollar cost averaging, you regularly invest a fixed dollar amount in a specific asset. It allows you to actively invest in the market even if you have only a small amount of money to put to work each month.

For example, consider a $300 monthly investment into an index fund that covers a broad range of stocks. When stock prices move higher, your $300 contribution will buy fewer shares. When values decline, your monthly contribution will purchase more shares. In this way, an investor avoids putting a large lump sum of money to work when an investment reaches peak value, and it can result in a lower average price per share, particularly through volatile market periods.

Focus on the long term with passive investing

Oftentimes, emotions can sabotage a buy-and-hold passive investment strategy. Overconfidence might lead you to trade too frequently, while fear of loss might cause you to hang on to investments that no longer support your goals or earn a sustainable return.

However, when you invest more regularly and focus on the long-term, you can feel confident that you’re steadily working toward your goals.

Learn how we approach your long-term investing success.

Equity securities are subject to stock market fluctuations that occur in response to economic and business developments. The S&P 500 Index consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. Dollar Cost Averaging does not assure a profit and does not protect against loss in declining markets. Such a plan involves continuous investment in securities regardless of fluctuating price levels and investors should consider their ability to continue purchases through periods of fluctuating price levels.

Tags:

Explore more

What is dollar cost averaging?

With dollar cost averaging, you invest small amounts of money regularly, bringing psychological benefits and encouraging a long-term approach to investing.

Personalized investing guidance aligned with your goals.

Let us help you craft a portfolio that reflects your goals, time-horizon and values.