ETFs may be a good option for you if you’re looking to minimize investing costs and capital gains taxes. They’re a cost-efficient way to diversify your portfolio and get broad market exposure.

Key takeaways

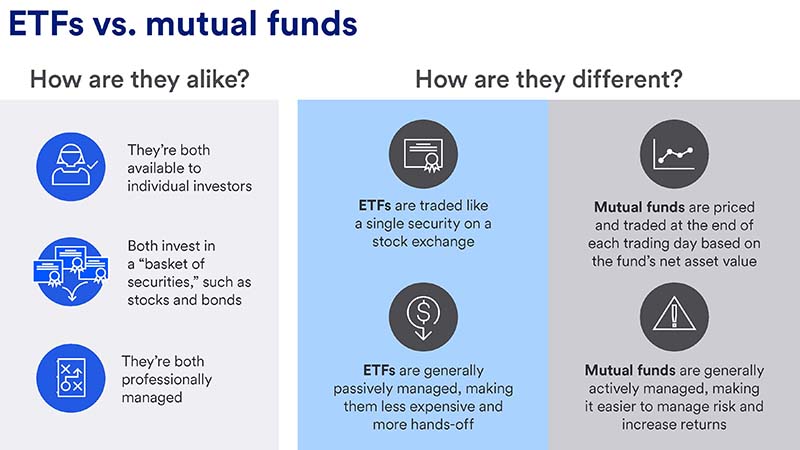

Mutual funds and ETFs are similar in a few ways, including that they are both a “basket of securities” that are designed to meet specific objectives.

Differences between ETFs and mutual funds include trading flexibility, management style and expense ratios.

A financial professional can help you build a portfolio that will help you achieve your goals, or you can invest in mutual funds or ETFs directly from an investment company.

Mutual funds and exchange traded funds (ETFs) are two types of investment vehicles available to individual investors. While similar, there are also important differences between them that you should understand as you build your investment portfolio.

Mutual fund vs ETF: How are they similar?

First, let’s look at the three main ways in which ETFs and mutual funds are similar:

- Both mutual funds and ETFs invest in what’s typically referred to as a “basket of securities” comprised of stocks and bonds. They are designed to meet specific objectives by investing in certain types of securities, such as U.S. stocks or the stocks of companies located in certain regions of the world.

- Both mutual funds and ETFs come with professional management. This means you don’t have to try to build your own portfolio of securities that will meet your risk and return objectives — a complex proposition given how many different types of securities there are to choose from.

- Purchasing a mutual fund or ETF gives you diversified exposure to a particular segment of the market without having to buy and sell hundreds of different securities yourself.

- There are several different types of mutual funds and ETFs, including stock, bond, balanced, income, money market, regional funds and international funds.

Now, let’s dive into how each of these investment vehicles work.

What is an ETF?

An ETF gives investors the ability to buy and sell shares on a stock exchange. ETFs are either passively or actively managed. Passive ETFs are required to track a specific index, investing in a basket of securities that replicate the performance of the index the fund tracks. Conversely, active ETFs aren’t required to track an index.

ETFs offer several notable advantages for investors looking for both long and short-term solutions.

- ETFs are tax efficient, since capital gains can be deferred.

- ETFs are flexible. They can be bought and sold like common stocks throughout the day through a brokerage account.

- ETFs typically offer lower fees than mutual funds, along with intraday liquidity.

What is a mutual fund?

A mutual fund is an investment vehicle that pools funds from many individual investors to purchase a diversified portfolio of securities (for example, stocks and bonds) in alignment with the fund’s objectives. With a mutual fund, you can benefit from economies of scale while diversifying risk across a wide range of investment securities.

A fund manager oversees the portfolio and decides how funds should be allocated across different sectors and businesses to meet the fund’s objectives. That’s one of the biggest benefits of mutual funds: They allow you to access a much broader range of different investments than you could if you bought securities on your own. Returns are based on the fund’s performance, less fees and expenses.

Mutual funds are increasingly popular investment options: In 2023, more than half of U.S. households owned shares in at least one mutual fund, compared with just 6% of households in 1980.

What’s the difference between exchange-traded funds and mutual funds?

The differences between ETFs and mutual funds involve how they’re constructed and traded.

Trading flexibility and timing

Even though they contain a basket of securities, ETFs are traded like a single security on a major U.S. stock exchange. ETFs can be bought and sold intra-day, just like any security. In contrast, mutual funds are priced and traded at the end of each trading day based on the fund’s net asset value (NAV). This means there’s less flexibility in terms of timing and price with mutual funds.

ETFs give you more control over when to enter the market and at what price. On the flip side, you may need to pay a trading commission when you invest in an ETF, something that usually doesn’t apply to mutual funds.

Management style

Most ETFs are passively managed. In other words, they’re designed to automatically track a market index, like the S&P 500. Most mutual funds, on the other hand, are actively managed, with the goal of outperforming a market index.

ETFs are usually more tax-efficient than mutual funds due to what’s referred to as the “creation/destruction” feature, where institutional investors can contribute or receive securities in exchange for ETF shares. As a result, the ETF does not need to realize gains to meet these investors’ redemption requests. This avoids taxable gains that would be passed to the remaining investors.

Expense ratios

The expense ratios for ETFs tend to be lower than mutual funds due to their passive management. In 2023, the average fund cost for actively managed funds was 1.01%, compared with 0.55% for passively managed funds, according to the Morningstar 2023 U.S. Fund Fee Study.

With their active trading, mutual funds tend to generate more capital gains than ETFs, which has tax implications for investors. When securities in a mutual fund are sold at a gain, the gain is passed on to shareholders, who must pay capital gains tax even if they don’t sell their mutual fund shares.

For this reason, mutual funds may often be held in tax-advantaged accounts like IRAs and 401(k)s, while ETFs are often held in taxable accounts, such as brokerage accounts.

ETF vs. mutual fund: Which is right for you?

The type of investment that’s right for you depends on your investing goals and objectives.

Consider an ETF if you want to minimize investing costs and capital gains taxes. ETFs provide more straightforward exposure to a market for investors who are cost-conscious and less concerned about picking and choosing individual securities. They’re a cost-efficient way to get broad market exposure and diversify your portfolio.

Conversely, consider a mutual fund if you want to automatically invest a set amount of money at certain intervals, such as monthly. This strategy, commonly known as dollar-cost averaging, is often used to build wealth over a long period of time to meet long-term objectives like saving for retirement. Mutual funds also tend to be a good choice if you want to not just track but attempt to beat the returns of market indices. Mutual funds offer the opportunity to manage risk and increase returns.

How to buy ETFs and mutual funds

If you want to research and construct an investment portfolio yourself, you can purchase ETFs and mutual funds directly from the investment companies that market and sell them. Or you can work with a financial professional to build a customized portfolio.

There are so many options when it comes to choosing ETFs and mutual funds that it can be overwhelming for some investors. A financial professional can help you narrow down the options and choose the right funds based on your investing goals, risk tolerance and time horizon.

Frequently asked questions about ETFs and mutual funds

A mutual fund may be a good option if you are investing for long-term goals and want to automatically invest a set amount of money at certain intervals, such as monthly. Mutual funds could also be a good choice if you want to try to beat the returns of market indices.

Because ETFs are passively managed and designed to automatically track a market index, they’re usually more tax efficient than mutual funds since there’s less turnover in securities and lower trading costs.

Take this quiz, offered by U.S. Bancorp Investments, to find an investing style that fits your needs.

Tags:

Explore more

Understanding how a diversification strategy can help your investment portfolio

Diversification is a key part of risk management, with the goal to enhance and preserve your investment portfolio’s value.

Personalized investing guidance aligned with your goals.

Let us help you craft a portfolio that reflects your goals, time-horizon and values.